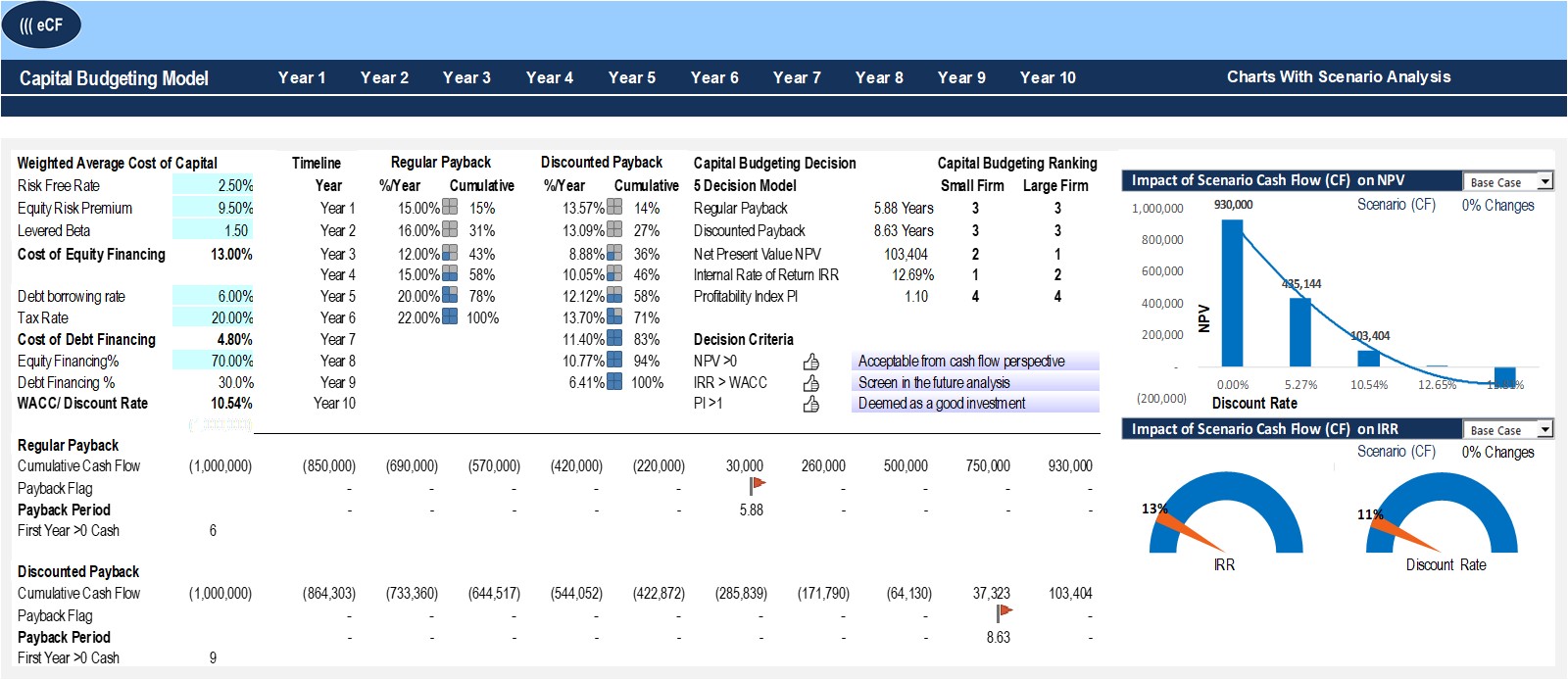

While the payback period method is easy to use, its disadvantages are significant. First, this method does not consider the actual profitability of a project. And second, this method does not consider the time value of money. how to charge interest on an invoice The time value of money concept states that money available today is inherently worth more than an identical amount of money available in the future. The time value of money is explored in more detail later in this chapter.

Discounted Cash Flow Analysis

In either case, companies may strive to calculate a target discount rate or specific net cash flow figure at the end of a project. Capital budgeting involves choosing projects that add value to a company. The capital budgeting process can involve almost anything, including acquiring land or purchasing fixed assets like a new truck or machinery.

What is the approximate value of your cash savings and other investments?

Read this case study on Solarcentury’s advantages to capital budgeting resulting from this software investment to learn more. Capital budgets (like all other budgets) are internal documents used for planning. These reports are not required to be disclosed to the public, and they are mainly used to support management’s strategic decision making. Though companies are not required to prepare capital budgets, they are an integral part in planning and the long-term success of companies. There are other drawbacks to the payback method that include the possibility that cash investments might be needed at different stages of the project.

Payback period

Many capital budgeting projects require multiple investments at different times during the project and produce uneven cash flows over the life of the investment. Capital investment (sometimes also referred to as capital budgeting) is a company’s contribution of funds toward the acquisition of long-lived (long-term or capital) assets for further growth. An operating expense is a regularly-occurring expense used to maintain the current operations of the company, but a capital expenditure is one used to grow the business and produce a future economic benefit. Annual net cash inflow is the net cash inflow yielded by the investment. Annual net cash inflow is also used for the payback period method.

Whether or not your IRR is good depends on your individual circumstances. Generally speaking, it will be good if it exceeds the “hurdle rate,” in other words, the cost of capital. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- By analyzing potential investment decisions through a strict process, businesses can ensure they make decisions that align with their long-term plans.

- A preference capital budgeting decision is made after these screening decisions have already taken place.

- This enables them to maximize shareholder wealth, which is the basic objective of each company.

- For this reason, capital expenditure decisions must be anticipated in advance and integrated into the master budget.

NPV also considers interest rates by considering your future earnings compared to if you invested elsewhere. While it might be easy to mentally forecast what kind of sales you could make next year, this might become more difficult when trying to project how a five or six-year $1bn investment will turn out. Ultimately, the main goal is to make smart decisions that will help the business grow and remain strong. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Decisions involve a high degree of risk and uncertainty as they project cash flows far into the future. External factors like economic conditions and technological advancements can significantly impact the success of long-term investments. The primary objective of capital budgeting is to maximize shareholder value by making informed and strategic long-term investment decisions. The discount factors provided in the tables cover two types of present value calculations, lump sum and annuity. Capital budgeting is used by businesses to analyze, prioritize, and evaluate investment in capital-intensive projects.

Since the payback period does not reflect the added value of a capital budgeting decision, it is usually considered the least relevant valuation approach. However, if liquidity is a vital consideration, then payback periods are of major importance. Instead of strictly analyzing dollars and returns, payback methods of capital budgeting plan around the timing of when certain benchmarks are achieved. For some companies, they want to track when the company breaks even (or has paid for itself). For others, they’re more interested in the timing of when a capital endeavor earns a certain amount of profit. Capital budgeting is important because it creates accountability and measurability.

Holly Rich is considering becoming an independent contractor for a national rideshare company as a second job. Her current car is older and not reliable enough to use for the business. She estimates that she can provide 40 rides per week and work 50 weeks per year. The new machine would generate $52,000 in annual revenue and $27,000 in annual cash expenses. The IRR for the Diamond LX model is 2% higher than the VIP Express model. As demonstrated in the preceding section, the simple rate of return for the Diamond LX model is 1.1% higher than the VIP Express model.

Column B lists the cash inflows and outflows for the project or investment. The example of Ancient Cities Tours is used to illustrate the capital budgeting decision making tools presented in this chapter. Ancient Cities Tours offers complete tour packages to historically significant Mayan, Aztec, and Inca sites in Latin America. The company owns the headquarters building and the equipment–tour bus, riverboat, and van–used for tours originating from the Peru location.

Net operating income includes some non-cash expenses like depreciation expense. Instead, it is the expense used to allocate the cost of a long-term asset over a period of time. Since the payback method uses annual net cash inflow, depreciation is not considered for this calculation. If net operating income is given, depreciation expense must be added back to arrive at annual net cash inflow. Managers are responsible for many decisions, some with short-term and others with long-term financial consequences. Projects and investments with long-term financial consequences are referred to as capital projects.